Power your payments vision with B4B as your

Banking as a Service Provider

Our BaaS platform provides all the necessary tools, APIs and infrastructure for you to build cutting-edge financial services with your own banking products specific to your business.

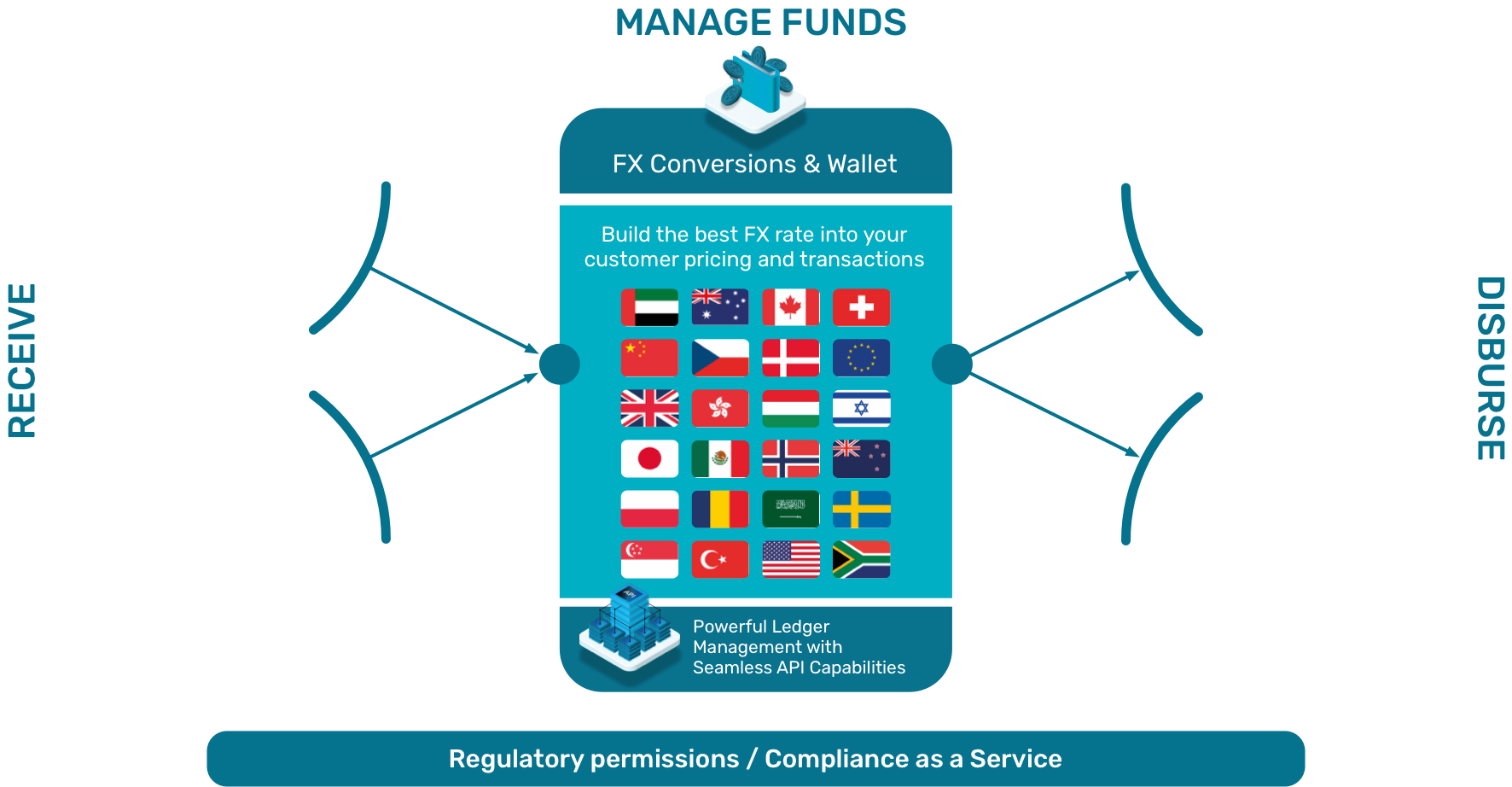

Our Payment Flows simplify the payment process, delivering a streamlined and user-friendly experience. Embrace the future of banking and elevate your business to new heights.

Accounts

customers to

create accounts

collect and hold

funds and

issue multiple

VIBANs

domestic and

international

payments

at scale

hold funds in

multiple currencies

to support settlement

for you or your

customers

multi-currency

cards to your

customers

anywhere, in your

branding

Why B4B?

With over 18 years of expertise in payments and now as part of the Banking Circle group of companies, B4B Payments has been recognised as a global provider of card issuing and embedded payment services. Operating as an E-Money Institution (EMI) in the UK and EEA, B4B holds Principal Membership with Mastercard. In the USA, the B4B Payments Visa® prepaid card is issued by Metropolitan Commercial Bank Member FDIC, pursuant to a license from Visa U.S.A. Inc.

Memberships

Our wide membership presence ensures that we are always up-to-date and committed to providing innovative solutions that make a difference: