Simplifying

Business

Payments

Globally

“Effortless, Compliant, Secure

Global Business Transactions”

Global Business Transactions”

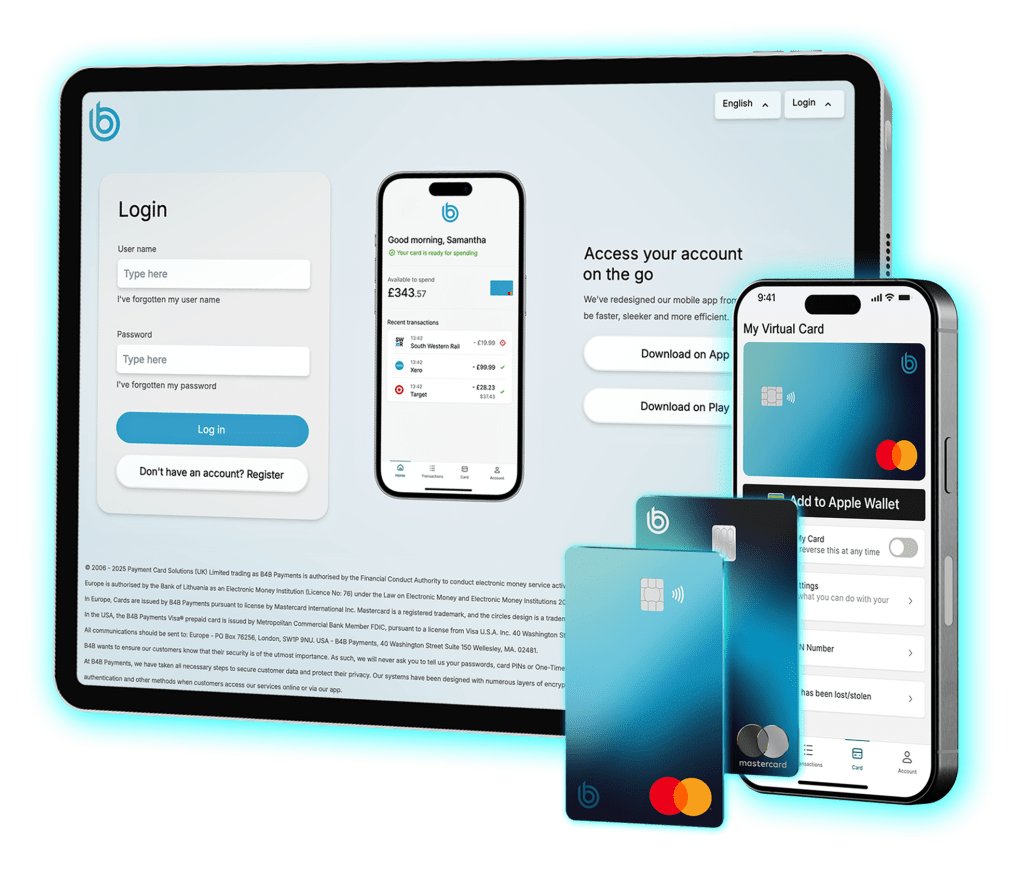

Trusted as a Principal Member of Mastercard & Visa

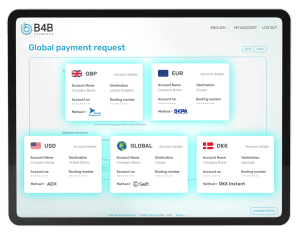

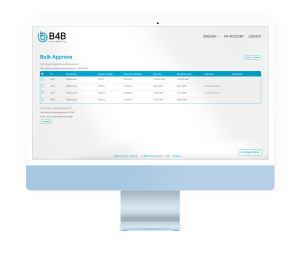

Our Banking-as-a Service platform provides all the necessary tools, APIs and infrastructure for you to build cutting-edge financial services with your own banking products specific to your business.