‘Why breaking up banking means better financial services’

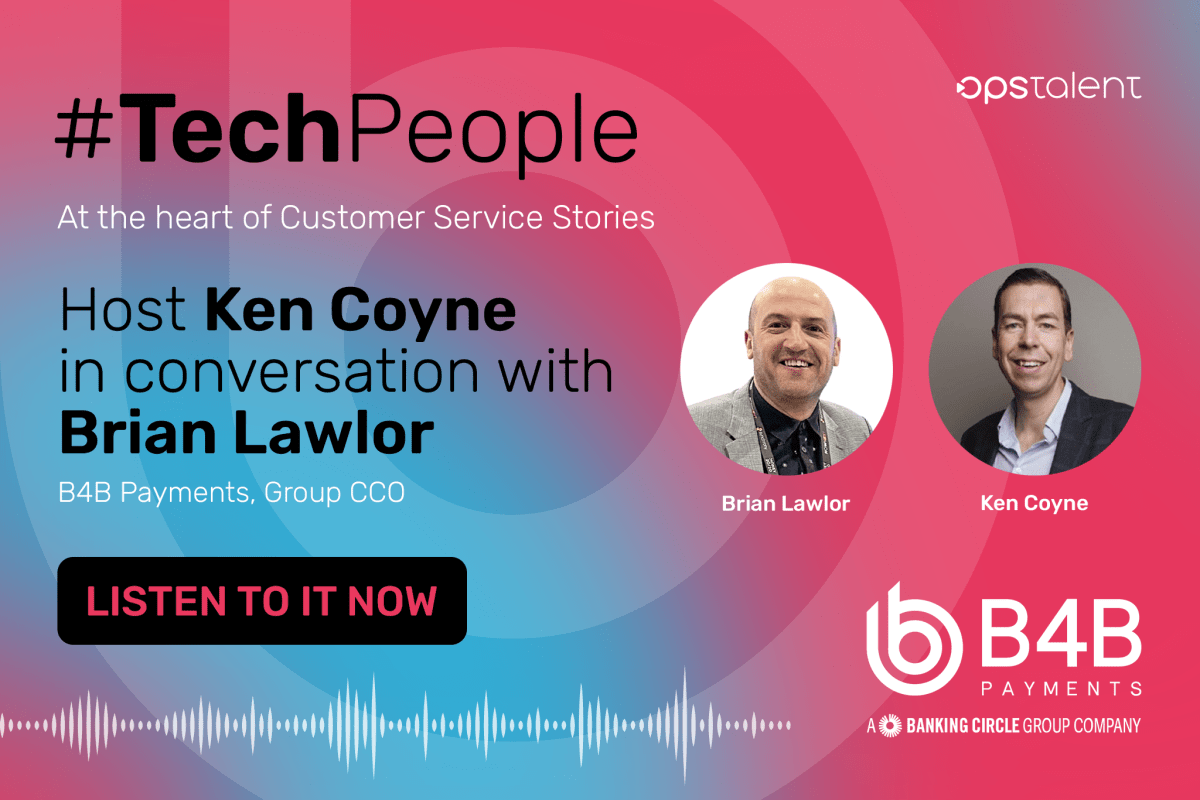

Legacy banking services will be a hot topic when Brian Lawlor, Group Chief Commercial Officer, B4B Payments, is the special guest on the Tech People podcast in January.

B4B Payments offers Banking as a Service (BaaS) technology that enables businesses to provide the kind of financial services that previously only banks could offer.

‘We are helping to break apart the old model. Through BaaS, we allow organisations to offer new and improved access to those core banking services such as issuing cards, making payments, or FX – and it can be virtually any type of business that takes advantage of that. Not just banks or even financial service companies.’

Brian met the podcast’s host, Ken Coyne, at Money 20/20 USA in October last year, and Ken was interested in learning more about Brian and the ethics driving B4B Payments.

The podcast seeks to show ‘how diversity, creativity, and innovation, when nurtured in people, can lead to an unbeatable formula’. This series of interviews ‘share the experiences of some truly inspirational leaders on their journey to customer success.’

Brian joins a long list of previous guests from major organisations across different types of technology industries organisations. Recent podcasts have featured Diane Acevedo, SVP, Operations and Customer Experience at Gabb Wireless, speaking about how to overcome the negative impacts of technology on children. Owen Fitzpatrick spoke about leadership principles and the importance of what leaders believe rather than what they think. David Urban, CEO of Auctioneer, shared his views about AI and the future of coaching for founders.

Brian will be sharing stories and learnings from his professional journey, leadership insights and the principles driving B4B Payments today.

Brian’s journey to Banking-as-a-Service (BaaS)

As part of his 20-year career, Brian has played vital roles in launching key fintechs, including Soldo, Revolut, Wise, Monzo and Juni. In 2020, Brian joined Banking Circle, which eventually acquired B4B Payments, an EMI in the UK and Lithuania and a principal member of both Visa and Mastercard. Following the acquisition, Brian assumed the role of Group Chief Commercial Officer at B4B Payments.

The benefits of BaaS are most widely felt across the whole eCommerce sector especially travel. Buyers can now not only choose the goods or services they want to buy but also select other banking products that might help them make their current purchase, such as a loan or apply for a card that rewards their future loyalty to their favourite brands.

Examples of B4B Payments impact

B4B Payments have a long history of shaking up industries and cutting through red tape.

Migrant Help is an organisation that provides invaluable initial assistance to victims of modern slavery and trafficking.

Exploited individuals often don’t have the ability to open a typical bank account. So, physical cash handouts were given to migrants for immediate help. This presented obvious risk and security issues. A prepaid Mastercard was the perfect alternative – offering all the benefits of a cash-free system without requiring the paperwork and process of an individual bank account.

B4B Payments are helping to make businesses more competitive, as showcased by the services it provides to two Danish fintechs, OneMoneyWay (insert link) and Zento (insert link). They are using B4B technology to simplify corporate payments for SMEs, eliminating the lengthy processes and high costs typically associated with opening a corporate bank account in Denmark.

Where to find Tech People

The episode of the Tech People podcast featuring Brian Lawlor will be published on (the 28 February) and available from all popular aggregators, including Apple and Spotify.