MPC Interviews the Head of Channels & Strategic Partnerships, Lori Breitzke, of B4B Payments.

Check out further information here.

MPC Interviews the Head of Channels & Strategic Partnerships, Lori Breitzke, of B4B Payments.

Check out further information here.

London, 19th March 2024 – Thredd, a leading modern payments processor serving clients globally, has announced its official entry into the United States debit and prepaid card issuing market with long-standing partner, B4B Payments. This strategic move underscores Thredd’s commitment to support its clients’ expansion plans in key global markets.

Check out further information here and the sources below.

PYMNTS – Thredd Enters US Card Issuing Market With B4B Partnership

Finextra – Thredd enters US debit and credit card issuing market

Fintech Finance News – Thredd Announces Expansion Into the United States Card Issuing Processing Market

Financial IT – THREDD ANNOUNCES EXPANSION INTO THE UNITED STATES CARD ISSUING PROCESSING MARKET

Fintech Global – Thredd partners with B4B Payments to launch US debit and prepaid card processing

Electronic Payments International – Thredd expands into the US card issuing market

Only Strategic – Thredd announces expansion into the United States card issuing processing market Trend

The Paypers – Thredd expands into the US market

B4B Payments, a global leader in electronic business payment solutions, has proudly announced that it has joined Payments as a Lifeline (PaaL) to significantly reduce the time it takes to provide financial assistance to individuals, especially during a natural disaster, emergency, or in cases of chronic aid.

Check out further information here.

“B4B is a key voice in the payments landscape, and they will continue to play a critical role in helping shape the future of payments.”

— Brian Tate, IPA President and CEO

Check out further information here.

Money 20/20 is like Christmas in many ways. There’s a lot of hard work and preparation in the run-up, especially if you are hosting a stand. And then it’s all a bit of a blur for a few fantastic days.

The B4B Payments team got together recently to unpack our observations, compare notes, and consolidate our learnings. Here are some of our key takeaways from Money 20/20 USA, held in Las Vegas.

After just a few minutes of walking the event floor, you would have been struck by one thing. Digital identity was front and centre, both in terms of exhibitor stands and speaker sessions.

In one lively panel session, the topic of data access and identity governance was discussed. Digital identity expert Dave Birch questioned whether consumers really knew the value of their own data and speculated that most of them ‘would be happy to give away all their personal data to Facebook for a Snickers bar.’ This clearly indicates there needs to be some formal structure for identity and data access that is fair and equitable for all parties.

A big talking point on the B4B Payments stand was the confusion between BaaS and embedded finance among our U.S. visitors.

Of those who had heard of BaaS, many did not really know the difference between it and embedded finance – or simply assumed they were the same thing.

By the end of the event, we had boiled down our explanation of the difference between the two into these three major areas:

Similarly, the metaverse was not such a hot topic as we all await stronger case studies and more decisive evidence of customer adoption.

The lack of open banking exhibitors or content highlighted the difference between the US and European markets. This is something that is likely to grow in the future as open banking gathers pace in the US.

The differences between the U.S. and Europe in terms of payment technology and experiences remain quite stark. One of the clearest examples of this was highlighted during the ‘Keeping Up with Expectations in Embedded Finance’ panel session at the start of Day 2.

Daniel Crisologo, Director of Payments from Nordstrom, stated that their business had only started offering contactless in response to the COVID outbreak in 2020. In the UK, the rollout of contactless payment acceptance by the largest organisations happened more than a decade ago. Contactless payments accounted for over 70 per cent of pay-as-you-go transactions at Transport for London (TfL) by 2022 – including paying for more than 2.5 billion TfL bus journeys in that time.

Similarly, BNPL was discussed as an emerging payment option for U.S. consumers, but it is well-established in the UK and Europe. BNPL is predicted to grow at 25% each year in the UK from 2022 to 2028. This is partly due to its ability to help consumers through the current cost of living crisis.

The panel discussed the importance of delivering a consistent customer experience. Whether you are serving consumers or business buyers, it is essential to make the same payment options available across all channels for a friction-free, high-converting buyer experience.

The trend towards digital wallets was a talking point, given predictions that their user base will grow strongly to exceed 5.2 billion globally by 2026, an increase of over 53% from 2022 levels. This is because of the potential for universal and merchant wallets to empower consumer purchasing and increase loyalty.

In a discussion that was relevant to both BaaS and embedded finance, the topic of commercial models was raised and the need to condense those across the virtual SaaS industry. Using a single service provider with one API integration is a good start. The need to simplify layers and connectivity in the payment orchestration process will also be key to preventing friction for buyers and impacting conversions.

As B4B Payments continues to grow from its UK base to the U.S., it is interesting to note the differences and nuances between these two dynamic markets. Money 20/20 remains the industry barometer for payment conversations and trends.

The interest in embedded payments is strong, and the U.S. market is beginning to understand the important differences and opportunities offered by Banking-as-a-Service.

In difficult economic times for both business buyers and consumers, it is good to see the payments industry continuing to focus on how it can most effectively empower businesses and enhance profitability.

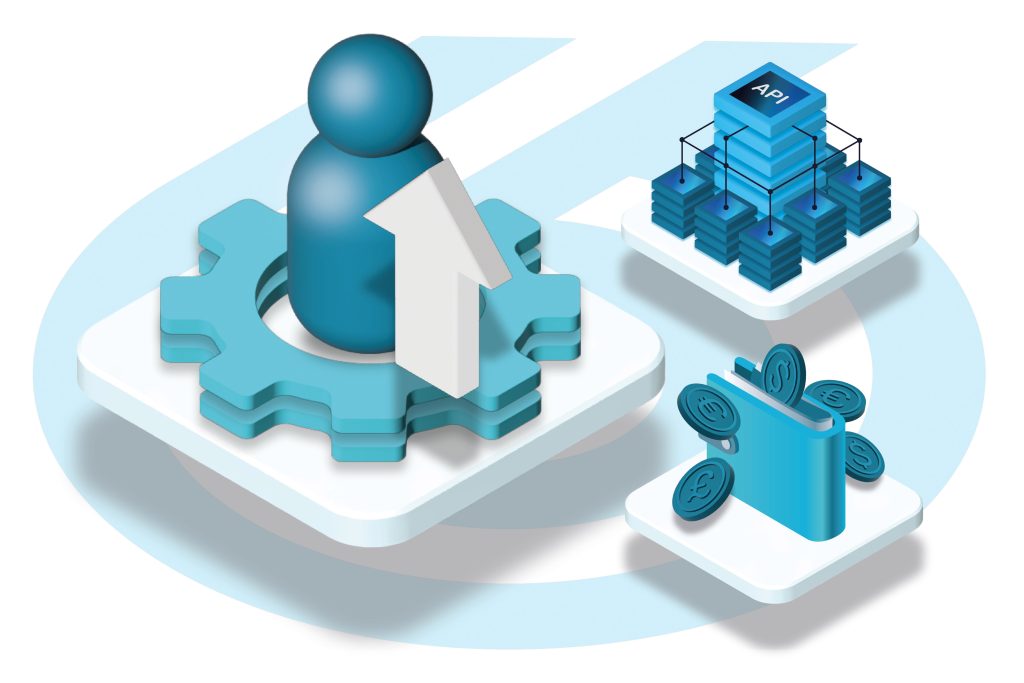

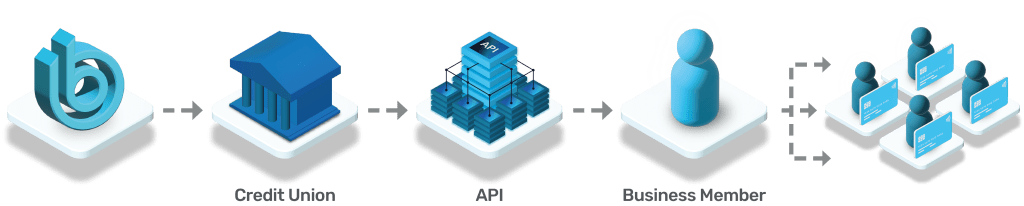

Credit unions represent a counterpart to conventional banks, and the banking industry’s recent shakeup has created an opportunity to gain new commercial business, especially the 29 million SMBs, with expanded business payment service offerings.

Speaking of opportunities, SMBs are shifting considerably away from large banks – which hold 45% of the market share, and 66% of business owners say their primary bank doesn’t get them. Additionally, B2B is the largest payment segment globally. In 2018, Goldman Sachs estimated B2B payments at $127 trillion. More recently, Credit Suisse pegged B2B payments at $125 trillion out of a $235 trillion total market. This outweighs the B2C payments market, estimated to be 52 trillion.

The demise of several banks in the spring has resulted in some SMBs reassessing their banking relationships beyond merely credit risks, and this is where credit unions can leverage their reputation for trustworthiness and commitment to community values to attract commercial clients.

Additionally, the shift allows credit unions to offer access to cutting-edge, self-service commercial prepaid products as an embedded payment solution that can grow in tandem with their SMB clients and make it easier for businesses to conduct expense management and payouts.

Unlike large banks, credit unions can swiftly adapt to the evolving needs of businesses and tailor their prepaid card programs accordingly. This agility is a key selling point for credit unions positioning themselves as dynamic, commercial payment partners for businesses.

One of the core strengths of credit unions is their commitment to personalized service and community focus. They can emphasize their local presence and understanding of the unique challenges facing businesses in their community. Commercial clients often appreciate the accessibility and personal touch that credit unions can provide, which may be lacking in larger, impersonal banks.

To compete effectively, credit unions can integrate prepaid cards seamlessly with other business services they offer. This includes aligning prepaid cards with business loans, lines of credit, and merchant services. By offering a comprehensive suite of financial solutions, credit unions become one-stop destinations for all of a business’s financial needs.

The first step towards success lies in recognizing that businesses have unique financial requirements. Credit unions can craft prepaid card solutions that cater specifically to these demands. Whether it’s facilitating employee expenses, managing petty cash, or optimizing cash flow, prepaid cards can be customized to align with the varied financial goals of commercial clients.

Managing expenses is a critical aspect of any business’s financial health. By offering prepaid cards equipped with integrated expense management tools, credit unions empower commercial clients to effortlessly track and categorize their spending. This streamlined process not only reduces administrative burdens but also provides invaluable insights into financial management.

Flexibility is the name of the game in the commercial world, where cash flow can make or break a business. Credit unions can provide prepaid cards that allow businesses to load funds as needed, ensuring access to working capital whenever required. This flexibility enhances financial stability and bolsters businesses’ confidence in their credit union partner.

Introducing loyalty or rewards programs tied to prepaid cards can be a game-changer for businesses. Small businesses can easily develop employee, channel partner, vendor, and customer incentives and reward schemes that enable them to strengthen their relationships. In return, this not only incentivizes continued usage but also deepens the loyalty between the credit union and its commercial clients.

Prepaid cards offer a window into a business’s financial activity. Credit unions can use this data to assess the financial health and stability of their commercial members, informing lending decisions and risk assessment. This proactive approach to risk management safeguards both the credit union and its clients.

Credit unions can explore collaborative partnerships with fintech companies like B4B Payments. These partnerships can help credit unions launch and optimize their prepaid card offerings with advanced technology and innovative features. By staying on the cutting edge of fintech, credit unions can compete with banks on the technological front.

B4B Payments can help credit unions quickly and easily launch and enhance their prepaid commercial card programs and compete with banks offering embedded payment solutions. Our end-to-end flexible and scalable prepaid commercial card issuing platform offers easy set-up and onboarding so commercial divisions can quickly enable businesses to self-manage the instant issue of physical and virtual Visa® cards for travel, entertainment, supplies, internal department and project spending, incentives and rewards.

Our robust APIs integrate seamlessly into existing bank systems and make it easy for your institution to offer a simple method for your credit unions to deliver businesses a valuable payment solution that also streamlines payments and gains them greater transparency and reporting capabilities.

With easy set-up and onboarding, commercial operations will not need additional staff or deal with lengthy and burdensome training and processes to begin enabling companies to self-manage the instant issue of physical and virtual Visa® cards for travel, entertainment, supplies, internal department and project spending, incentives, and rewards.

Credit unions have a competitive edge in the commercial banking space when armed with well-designed prepaid card programs. By capitalizing on their flexibility, commitment to personalized service, competitive pricing, and strategic partnerships, credit unions can effectively compete with banks for commercial clients. The key lies in understanding businesses’ unique needs, providing innovative solutions, and showcasing the distinct advantages credit unions offer as financial partners.

Clinical trials are the backbone of medical research, providing crucial insights into the efficacy and safety of new treatments and therapies. However, one persistent challenge that plagues the field is the under-representation of diverse populations in these trials. This lack of diversity not only hampers the validity of study results but also limits the applicability of findings to broader communities.

Vulnerable populations, including those who are rural, poor, unbanked, under-educated, or chronically ill, often face barriers to participation due to concerns about payment methods or a lack of trust in the system. The solution to these challenges might be embracing modern and efficient digital payment solutions.

The Impact of Under-Representation

Under-representation in clinical trials has far-reaching consequences that extend beyond research. When certain demographic groups are left out, study results may not accurately reflect how a treatment will perform in the real world.

There are even cases where sample sizes are often too small to permit assessment of treatment efficacy within particular subgroups.

This can lead to less effective or unsafe treatments, ultimately perpetuating health disparities. Additionally, the lack of diversity in clinical trials can hinder the development of personalized medicine, where treatments are tailored to individual genetic and environmental factors.

Barriers to Participation

Vulnerable populations often face unique barriers that discourage their participation in clinical trials. Payment methods are one such barrier. Many individuals, particularly those from underserved communities, may not have traditional bank accounts, making it difficult to receive compensation for their participation. A World Bank 2021 report stated more than 1.4 billion people worldwide remained unbanked. This is especially true for rural or remote populations with limited banking infrastructure. Moreover, concerns about the security and transparency of payment systems can deter potential participants who fear their personal information might be compromised.

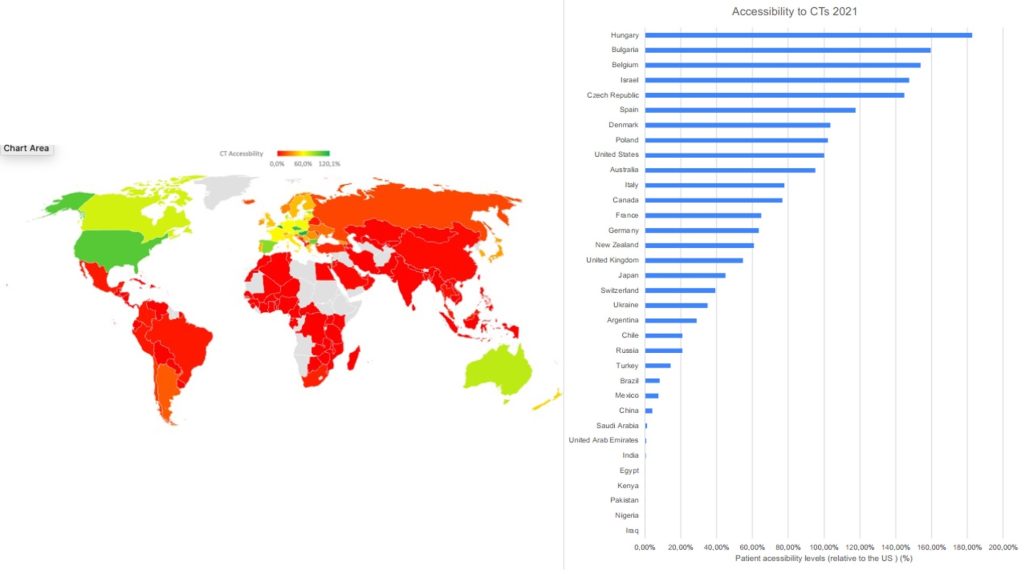

Figure: Accessibility to clinical industry clinical trials, calculated as number of clinical trial sites per 1 million in population relative to the U.S. levels (U.S. = 100%). LongTaal Clinical Trials Landscape dashboard/clinical Trials Indices. Source VIARES Academy for Clinical Research. Source ClinicalLeader

Building Trust and Accessibility with Digital Payments

Digital payment solutions can transform the landscape of clinical trial participation by addressing some of these barriers head-on. One of the key advantages of digital payments is their accessibility. Mobile phones are increasingly prevalent, even in low-income or rural areas, providing participants with a secure platform to receive compensation. Digital wallets or prepaid cards can be quickly loaded with the agreed-upon compensation amount, ensuring participants can access their funds without needing a traditional bank account.

Reloadable, prepaid debit cards are convenient, allowing for instant processing and automated differentiation between taxable and tax-exempt expenditures. These digital solutions also foster trust through their transparency. Participants can track their payments in real-time via mobile or desktop devices, alleviating concerns about the legitimacy of the payment process. The use of secure encryption protocols and stringent data protection measures further bolster the security of these payment methods, assuaging fears about personal information being compromised.

Driving Inclusivity Through Efficiency

Efficiency is another hallmark of digital payment solutions. Traditional payment methods, such as checks, can be time-consuming and subject to delays. This is especially problematic for individuals who may be living paycheck to paycheck or facing financial instability. Digital payments eliminate these delays, ensuring that participants receive compensation promptly. This demonstrates respect for participants’ time and contribution and removes a significant logistical barrier that might otherwise discourage participation.

A Shift Towards Inclusivity

Adopting digital payment solutions represents a crucial shift towards inclusivity in clinical trials. By removing the barriers posed by payment methods and enhancing transparency and efficiency, these solutions can make trials more appealing and accessible to a broader spectrum of participants. Vulnerable populations can now participate without worrying about payment delays or security breaches, contributing to a more diverse and representative participant pool.

In the pursuit of medical advancements, clinical trials must reflect the diversity of the populations they aim to serve. Under-representations can compromise the validity and applicability of study results, perpetuating health disparities. Digital payment solutions like prepaid debit cards have the potential to break down barriers and increase diversity by providing accessible, transparent, and efficient methods of compensation. As the field of medical research continues to evolve, embracing these solutions could be the key to fostering inclusivity and driving forward healthcare breakthroughs that benefit everyone, regardless of their background or circumstances.

Clinical trials are crucial in advancing medical knowledge and improving patient care. However, the administrative tasks associated with managing participant compensation are often a significant burden for researchers and site personnel. According to recent studies, 44% of site personnel engaged in accounting also juggle other study-related responsibilities. This administrative workload can detract from the scientific focus of the research process. Fortunately, there are innovative solutions to address these challenges and streamline the compensation process.

Adopting digital payment platforms is one of the most promising advancements in simplifying clinical trial participant compensation. Traditional methods of compensation disbursement often involve manual paperwork, which is not only time-consuming but also prone to human errors. By embracing digital payment platforms, researchers can automate the compensation disbursement process, reducing the need for extensive paperwork. Digital payment platforms offer secure and seamless compensation transfers, ensuring that participants receive their compensation in a timely manner. This enhances participant satisfaction and frees up valuable time for researchers and site personnel. Instead of allocating significant hours to processing payments, these individuals can redirect their efforts towards more critical aspects of the trial.

Moreover, prepaid debit cards have become a convenient and flexible payment method for clinical trial participants. These cards can be loaded with compensation funds and used just like regular debit cards, issued instantly as either a virtual or physical card, and provide participants with a hassle-free way to access their funds. Prepaid debit cards offer participants the freedom to choose how and when to use their compensation. This flexibility enhances participant satisfaction and encourages continued engagement and participation in the trial.

One of the most compelling advantages of digital payment platforms is the potential for significant time and cost savings. Research indicates that implementing such platforms can save up to 15 minutes per participant, considerably reducing administrative burden. These time savings compound as the number of participants in a clinical trial increase.

Researchers can devote more attention to study design, data analysis, and patient care by reallocating these saved hours. Furthermore, the cost savings associated with transitioning to digital payment platforms should not be overlooked.

By digitizing payments, administrators can significantly reduce manual paperwork, printing, and postage costs, leading to considerable financial benefits throughout a clinical trial. These cost savings can be reinvested into other research areas, contributing to the overall success of the study.

Automated payment tracking systems have gained traction further to improve the transparency and efficiency of the compensation process. By automating payment tracking, researchers can identify and promptly address discrepancies or issues. This proactive approach prevents potential delays in compensation disbursement and maintains participant trust throughout the trial.

These payment systems provide real-time monitoring of compensation disbursement, allowing researchers and site personnel to have a clear overview of payment statuses. Real-time tracking minimizes the risk of errors and ensures accurate record-keeping, thus enhancing transparency and compliance.

The administrative burden of managing participant compensation in clinical trials has long been a challenge for researchers and site personnel. However, the landscape is changing with the emergence of innovative payment solutions, such as digital payment platforms, prepaid debit cards, and automated payment tracking systems.

Solutions like B4B Payments’ instant prepaid card issuing platform streamline the compensation process, offer substantial time and cost savings, enhance participant satisfaction, and improve trial transparency. Advanced, easy-to-use payment platforms allow researchers to focus more on their work’s scientific aspects, drive progress in medical research, and ultimately improve patient care.

Clinical trials are an essential cornerstone of medical research, enabling the development of new treatments and therapies that can revolutionize healthcare. However, Clinical Research Organizations (CROs), sponsors, and independent trial sites often face significant challenges in recruiting and retaining participants, leading to delays and increased costs.

One crucial factor that can address these bottlenecks is the optimization of participant payment processes. By providing timely and seamless compensation, researchers can incentivize participants to enroll and ensure their commitment throughout the trial.

Participant recruitment and retention are notorious hurdles in the world of clinical trials. Lengthy recruitment processes and high dropout rates can lead to delayed trial completion, increased expenses, and compromised data accuracy.

The reasons for these challenges are multifaceted, ranging from stringent eligibility criteria to the burden of participation. One effective strategy to address these issues lies in optimizing the payment experience for participants.

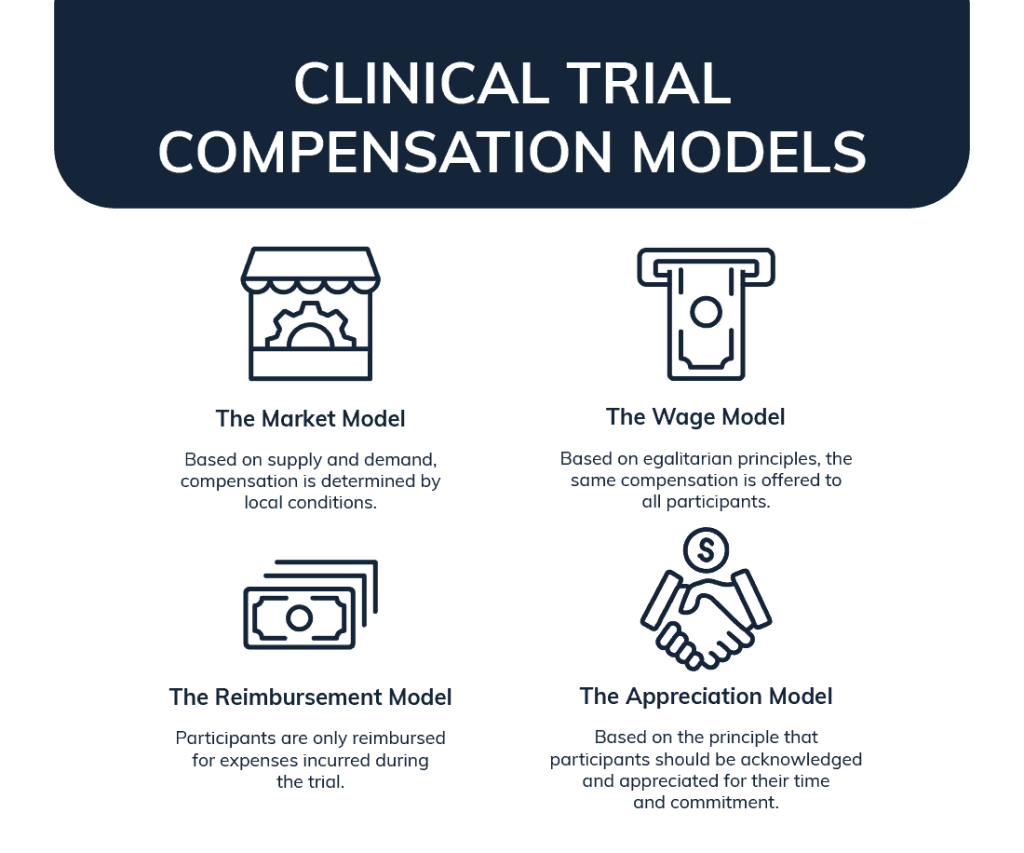

One of the primary reasons individuals consider participating in clinical trials is the compensation offered for their time, effort, and potential health risks. In one survey, 39% of participants reported compensation as their primary motive for participating in clinical trials.

This percentage can go up to 90% for healthy volunteers. Optimizing payment processes is an effective way to incentivize participants to enroll and actively engage in the trial. The amount of payment for participation should not be overlooked, as this recent headline points out: Paying research participants — a lot — may be a key to increasing diversity in studies.

Timely, reliable, and hassle-free compensation fosters a sense of value and appreciation, boosting participants’ motivation to actively engage in the trial, follow protocols, attend appointments, and provide accurate data.

Source: TrialFacts

Efficient payment solutions, such as B4BPayments’ prepaid cards, are pivotal in streamlining payment processes for clinical trial participants. Prepaid cards offer a convenient and secure way to deliver compensation promptly, eliminating manual processes and the delays associated with traditional payment methods like checks or bank transfers.

The global prepaid card market, projected to reach $4.1 trillion in transaction value by 2026, according to Juniper Research, attests to the increasing demand for this convenient form of payment. This growth is primarily driven by emerging markets, where the reach of traditional banking systems may not be as extensive.

We have made it easy to overcome the burdens of administrative tasks, empowering sites to have more time to focus on research. B4B Payments’ all-in-one, intuitive management platform gives administrators full control and the power to instantly issue or schedule and automate the issuance of reloadable Visa prepaid physical and virtual cards globally with the agreed-upon compensation amount, for single or multiple trials and set milestones.

Administrators gain a new level of transparency in tracking each account and payment made, B4B Payments is a technology-first company, and we have designed an easy-to-use platform that flawlessly integrates into existing accounting and program management software.

Moreover, prepaid cards reduce the necessity for trial participants to have a bank account, use currency exchanges, or wait to receive checks in the mail. Trial participants can receive funds immediately for incentives, completion of milestones, and reimbursements. With increased consumer adoption of digital payments, cardholders can use a friendly mobile application to easily add their cards to highly used Apple or Google wallets for seamless mobile payments and manage their cards.

By adopting a simple, digital prepaid approach to participant compensation, operators can foster inclusion and diversity and ensure that participants receive their compensation without unnecessary friction, which can significantly impact their overall trial experience.

The goal of optimizing payment processes is to improve participant retention rates. When participants have a positive payment experience and feel well compensated for their time and efforts, they are more likely to stay enrolled in the trial until completion. Studies have shown that participants who are paid promptly and without inconvenience are 2.5 times more likely to complete the required clinical trial steps than those who face payment-related challenges.

Higher retention rates translate to more accurate and comprehensive data collection, which is vital for drawing reliable conclusions from the trial. Reliable data is essential for gaining regulatory approval, advancing medical knowledge, and bringing new treatments to market. By prioritizing payment optimization, researchers can significantly contribute to their clinical trials’ success and healthcare’s overall advancement.

Optimizing payment processes is a critical yet often overlooked aspect of ensuring the success of clinical trials. As the healthcare industry continues to evolve, prioritizing payment optimization can be a game-changer in achieving successful clinical trials that drive meaningful progress. Contact B4B Payments to learn how we can help optimize the trial experience.

The holiday season presents a perfect opportunity for businesses to strengthen employee and partner retention efforts. One of the easiest and fastest-growing ways companies can deliver thanks is by presenting virtual cards.

It’s no surprise that the global virtual gift card market is estimated to grow by $420.49 billion, with a CAGR of 20.13 % between 2021 to 2026, according to an Infiniti Research market study. The rapid digitalization of currency, the increased usage of contactless payments via tap-and-pay physical point-of-sale devices and eCommerce, and the convenience factor virtual cards offer are key reasons why this digital alternative to traditional physical gift cards is growing rapidly.

Companies and consumers alike have realized that obtaining and sending physical gift cards can be time-consuming and expensive, especially if you have a large number of recipients on your list. The cost typically incurred by a company looking to present physical cards includes having an additional budget for packaging and shipping, and should the package get lost or stolen, then the cost to reship comes into play.

An unfortunate reality today is that logistics and shortages are creating unexpected delays in shipping and handling, even with drop shipping. Sending physical gift cards to employees and partners is even more expensive and complicated for businesses with a global presence.

Sending a virtual gift card directly through email is more efficient and cost-effective. An advantage of using virtual cards for your business is that the cardholder can use their card immediately. No need to wait for a traditional card to be sent in the mail. As soon as the card is created and funds loaded, the user will receive an email with instructions on retrieving their new card details.

Other benefits of offering virtual gift cards to employees, team members, or partners include:

Flexibility and choice

Offering a virtual gift card, supported by major networks like Visa and MasterCard, ensures your recipients receive the gift of choice. This means they can reward themselves with whatever is most important to them. With no limitations, each recipient can choose a gift that’s perfect for them. The flexibility of virtual cards also easily allows recipients to donate to charitable organizations.

Support Sustainability Values

The rapid digitization of the world is supporting growing interest and focus on sustainability. Companies are becoming more aware of consumer interest and demand for sustainability and transforming and innovating their businesses to stay relevant. In fact, 85 percent of consumers have shifted toward being more sustainable during the past five years, according to a recent survey by Simpon-Kucher strategy and marketing agency. A virtual gift card has a small carbon footprint, and unlike physical cards and gifts that may not really be on anyone’s wish list, won’t end up in a garbage fill.

To find out more, please complete our form HERE and we will be in touch.