Credit unions represent a counterpart to conventional banks, and the banking industry’s recent shakeup has created an opportunity to gain new commercial business, especially the 29 million SMBs, with expanded business payment service offerings.

Speaking of opportunities, SMBs are shifting considerably away from large banks – which hold 45% of the market share, and 66% of business owners say their primary bank doesn’t get them. Additionally, B2B is the largest payment segment globally. In 2018, Goldman Sachs estimated B2B payments at $127 trillion. More recently, Credit Suisse pegged B2B payments at $125 trillion out of a $235 trillion total market. This outweighs the B2C payments market, estimated to be 52 trillion.

The demise of several banks in the spring has resulted in some SMBs reassessing their banking relationships beyond merely credit risks, and this is where credit unions can leverage their reputation for trustworthiness and commitment to community values to attract commercial clients.

Additionally, the shift allows credit unions to offer access to cutting-edge, self-service commercial prepaid products as an embedded payment solution that can grow in tandem with their SMB clients and make it easier for businesses to conduct expense management and payouts.

Unlike large banks, credit unions can swiftly adapt to the evolving needs of businesses and tailor their prepaid card programs accordingly. This agility is a key selling point for credit unions positioning themselves as dynamic, commercial payment partners for businesses.

Personalized Service and Local Focus

One of the core strengths of credit unions is their commitment to personalized service and community focus. They can emphasize their local presence and understanding of the unique challenges facing businesses in their community. Commercial clients often appreciate the accessibility and personal touch that credit unions can provide, which may be lacking in larger, impersonal banks.

Seamless Integration with Business Services

To compete effectively, credit unions can integrate prepaid cards seamlessly with other business services they offer. This includes aligning prepaid cards with business loans, lines of credit, and merchant services. By offering a comprehensive suite of financial solutions, credit unions become one-stop destinations for all of a business’s financial needs.

The first step towards success lies in recognizing that businesses have unique financial requirements. Credit unions can craft prepaid card solutions that cater specifically to these demands. Whether it’s facilitating employee expenses, managing petty cash, or optimizing cash flow, prepaid cards can be customized to align with the varied financial goals of commercial clients.

Seamless Expense Management

Managing expenses is a critical aspect of any business’s financial health. By offering prepaid cards equipped with integrated expense management tools, credit unions empower commercial clients to effortlessly track and categorize their spending. This streamlined process not only reduces administrative burdens but also provides invaluable insights into financial management.

Flexible Funding for Businesses

Flexibility is the name of the game in the commercial world, where cash flow can make or break a business. Credit unions can provide prepaid cards that allow businesses to load funds as needed, ensuring access to working capital whenever required. This flexibility enhances financial stability and bolsters businesses’ confidence in their credit union partner.

The Loyalty and Rewards Advantage

Introducing loyalty or rewards programs tied to prepaid cards can be a game-changer for businesses. Small businesses can easily develop employee, channel partner, vendor, and customer incentives and reward schemes that enable them to strengthen their relationships. In return, this not only incentivizes continued usage but also deepens the loyalty between the credit union and its commercial clients.

Prepaid cards offer a window into a business’s financial activity. Credit unions can use this data to assess the financial health and stability of their commercial members, informing lending decisions and risk assessment. This proactive approach to risk management safeguards both the credit union and its clients.

Collaborative Teamwork

Credit unions can explore collaborative partnerships with fintech companies like B4B Payments. These partnerships can help credit unions launch and optimize their prepaid card offerings with advanced technology and innovative features. By staying on the cutting edge of fintech, credit unions can compete with banks on the technological front.

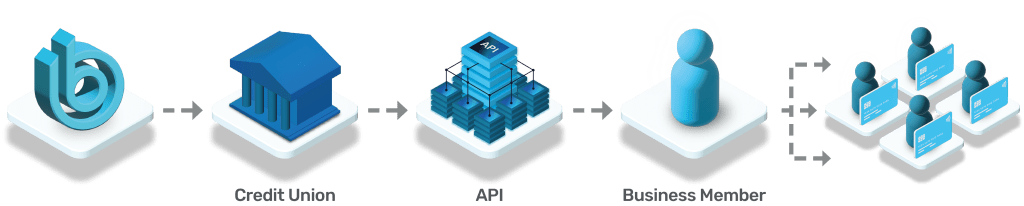

B4B Payments can help credit unions quickly and easily launch and enhance their prepaid commercial card programs and compete with banks offering embedded payment solutions. Our end-to-end flexible and scalable prepaid commercial card issuing platform offers easy set-up and onboarding so commercial divisions can quickly enable businesses to self-manage the instant issue of physical and virtual Visa® cards for travel, entertainment, supplies, internal department and project spending, incentives and rewards.

We’ve Made It Simple

Our robust APIs integrate seamlessly into existing bank systems and make it easy for your institution to offer a simple method for your credit unions to deliver businesses a valuable payment solution that also streamlines payments and gains them greater transparency and reporting capabilities.

With easy set-up and onboarding, commercial operations will not need additional staff or deal with lengthy and burdensome training and processes to begin enabling companies to self-manage the instant issue of physical and virtual Visa® cards for travel, entertainment, supplies, internal department and project spending, incentives, and rewards.

Credit unions have a competitive edge in the commercial banking space when armed with well-designed prepaid card programs. By capitalizing on their flexibility, commitment to personalized service, competitive pricing, and strategic partnerships, credit unions can effectively compete with banks for commercial clients. The key lies in understanding businesses’ unique needs, providing innovative solutions, and showcasing the distinct advantages credit unions offer as financial partners.