By Marchelle Becher, US Business Development Executive

Millions of people are impacted by natural disasters each year, facing financial challenges such as damage to homes, the need for temporary shelter, and the replacement of personal items and food. Increasingly, fintech solutions are becoming essential in addressing these urgent needs efficiently and effectively.

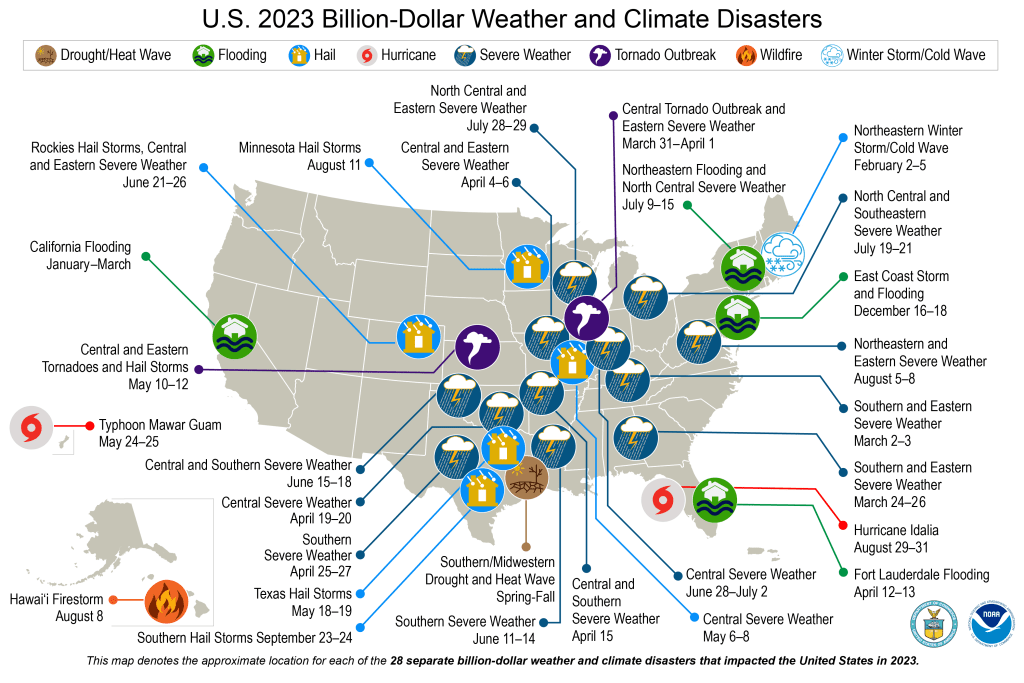

Over the past five years, the US has experienced an average of $18 billion annually in natural disaster-related damages. With increasingly extreme weather patterns, this trend is expected to worsen. In the first half of 2024 alone, the US has already experienced 11 confirmed weather/climate disaster events with losses exceeding $1 billion each, well ahead of the expected 5-year average.

Having attended several conferences dedicated to disaster aid and preparedness, it’s clear that private and public organizations are actively seeking viable solutions. Companies like B4B Payments are crucial in providing financial aid distribution and ongoing support for those affected by disasters, especially regarding financial inclusion.

Addressing Financial Vulnerability and Inclusion

Low-income households are disproportionately affected by disasters. Many do not qualify for disaster loans, and grants often fall short. Delays in relief efforts compound their financial vulnerability. However, changes are taking place to improve support for those impacted by these life-changing events.

The Federal Emergency Management Agency (FEMA) overhauled its aid distribution methods earlier this year. One fundamental change, made effective March 22, addresses disaster victims’ economic challenges. FEMA’s Displacement Assistance program now provides money for shelter not only to those who had to leave their homes but also to those who were already homeless. As FEMA stated, this change is a “more equitable and efficient” approach, overcoming the challenge and addressing the disparity of helping only those who can pay their hotel bills upfront.

Additionally, FEMA has created the Serious Need Assistance program, providing $750 to individuals for severe or immediate needs such as water, food, first aid, infant formula, diapers, personal hygiene items, or fuel for transportation. This payment is in addition to aid for home repairs and other disaster-related needs.

In 2023, the United States experienced 28 separate weather or climate disasters that each resulted in at least $1 billion in damages. NOAA map by NCEI.

The Urgent Need for Preparedness Funds

With improved fund issuance, private and public agencies are stepping up efforts to work with companies like B4B Payments on “Preparedness Funds”—pre-arranged financial resources and distribution solutions that can be quickly activated in the event of a disaster. The “Preparedness Funds” approach improves financial inclusion, reduces the time needed to distribute funds, and eliminates the potential for theft and fraud with the self-service platform.

Supporting disaster preparedness and relief to ensure funds reach those in need is a critical focus for B4B Payments. Financial technology companies can simplify and expedite relief payments, ensuring a smooth customer experience and efficient distribution of funds, especially compared to manual or paper-based methods.

B4B Payments’ Comprehensive Solution

We offer a seamless prepaid card payout solution that considers the entire ecosystem, from funders to survivors, ensuring secure and efficient fund distribution. With our self-managed, instant issue platform, organizations and agencies can send physical and virtual prepaid cards to those in need, allowing for quick fund distribution while achieving full transparency, reporting capabilities, security, and guaranteed regulatory compliance.

Key benefits of working with B4B Payments include:

- Instant issuing and delivery with activation timing control and funding flexibility, allowing agencies to choose when to activate cards, reload, and options to send either physical or virtual cards.

- Secure, self-service platform offering full management and program control with the ability to set hierarchy-based access.

- Real-time reporting capabilities to monitor programs, identify trends, and develop valuable insights, easing analysis access data within a specific time-period view transaction volume, merchant category spend, and ATM usage.

- A simple mobile interface enables recipients to block their cards if they are lost or stolen and access accurate, real-time account information.

By leveraging our global payment solutions, our partners can better prepare for and respond to disasters, ultimately building stronger, more resilient communities.

B4B Payments’ Comprehensive Solution

B4B Payments is a proud member of Payments as a Lifeline (PaaL), and we are committed to transforming disaster relief efforts through innovative financial solutions. If your agency wants to improve its aid distribution methods and ensure rapid, secure, and transparent fund disbursement, we invite you to partner with us. Together, we can significantly impact the lives of those affected by natural disasters.

Visit our Disaster/Humanitarian Information Page for more information.