By Susie Shyatt, US Business Development Executive

When it comes to corporate events, efficient financial management is critical. Whether you’re organizing a corporate retreat, an industry conference, or a large-scale public event, managing expenses smoothly and transparently is essential. Corporate-funded prepaid cards are transforming how companies handle event payments, making the process easier and more efficient.

The Pain Points of Traditional Payment Methods

The reality is that traditional payment methods like checks, ACH transfers, cash, and vouchers are riddled with challenges. Checks are costly, not just in terms of fees but also the time and resources required to process them. Someone has to be on-site to issue a check, and the recipient must have a bank account to access the funds.

ACH transfers, while more modern, still fall short. They’re slow, expensive, and offer no way to retract funds once they’re sent. Cash, on the other hand, brings its own headaches: manual handling, the risk of loss or theft, and high distribution fees.

Vouchers might sometimes work, but they’re limited in where they can be used and are often difficult to track. Issuing vouchers is usually a manual process, adding another layer of complexity to an already cumbersome system.

A Modern and Simple Solution

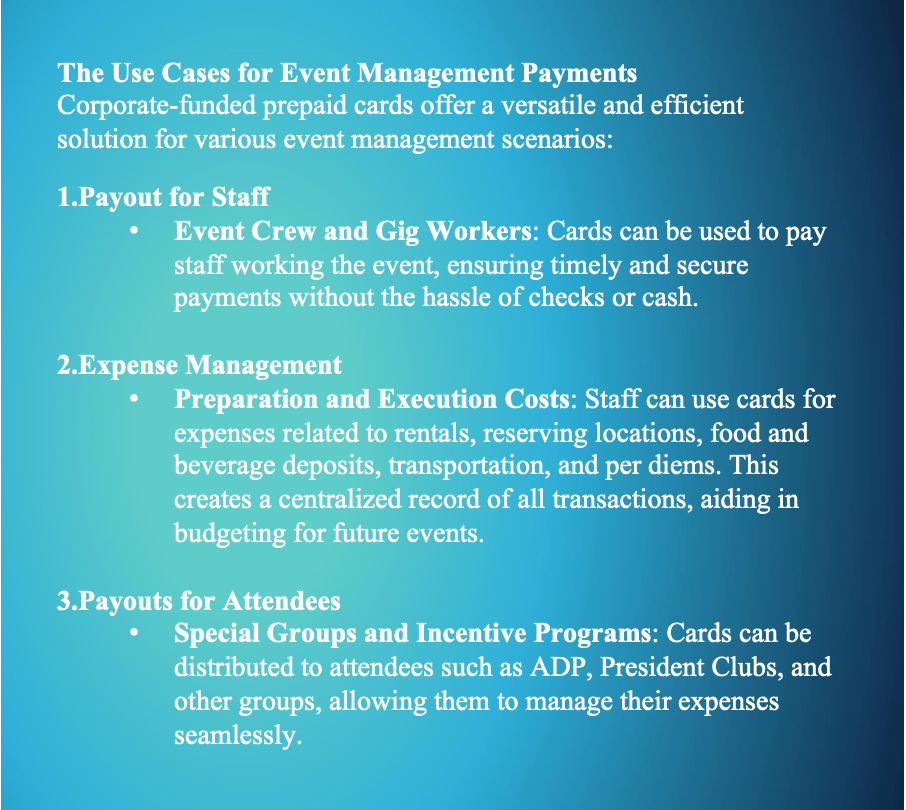

Corporate-funded prepaid cards offer a straightforward, effective solution to these issues. With these cards, you can load funds quickly and make them instantly available, simplifying the entire process of paying staff, covering event expenses, and distributing funds to attendees.

For example, when paying event crews or gig workers, self-issuing cards ensure that payments are secure and timely, eliminating the need for checks or cash. Managing expenses is equally simple. Staff can use the cards for rentals, deposits, transportation, per diems—whatever the event demands. And because every transaction is centrally recorded, budgeting for future events becomes much more manageable.

Attendees, such as members of President’s Clubs, can also benefit. They can receive cards to manage their own expenses without the limitations of traditional payment methods.

B4B Payments’ prepaid cards enable instant payouts, with funds immediately available. The platform is user-friendly, allowing you to manage all cards from a single dashboard, with features like freezing and reissuing lost or stolen cards. This doesn’t just save time; it provides peace of mind.

Additionally, these cards are inclusive, providing funds to underbanked or unbanked individuals and ensuring that everyone involved in your event is taken care of. Reloadable cards make recurring payments seamless, letting users meet their needs without disruption.

For companies with a global reach, our cards can be issued in multiple currencies, eliminating foreign exchange fees by transacting in local currencies. This global flexibility ensures your events run smoothly, no matter where they’re held.

Tailored Solutions for Key Stakeholders

Our solution isn’t one-size-fits-all; it’s designed to meet the needs of all organizational roles involved in event management:

- Event Operations: Simplify logistics and vendor coordination.

- Finance: Streamline payments and budgeting while ensuring financial transparency.

- Human Resources: Ensure smooth, timely payouts to employees and staff.

By adopting corporate-funded prepaid cards, you’re not just simplifying your event management process—you’re cutting costs and enhancing financial transparency. Our solution directly addresses the pain points of traditional payment methods, providing a modern, efficient alternative tailored to the needs of today’s corporate finance leaders.