No matter how established a business is, regularly looking for ways to cut and control costs and eliminate unnecessary expenditure is good business practice. In uncertain times, and when faced with an uncertain economy, every penny truly does count and even successful businesses should re-evaluate how they can cut costs.

1. Look for ways to be environmentally friendly

While swapping your bulbs for LEDs and installing solar panels may seem like unnecessary business expenses, in the long-term, they can help your business to save a significant amount of money. You can also encourage your employees to make better eco choices, such as switching off their computers rather than leaving them on stand-by and opting for digital documents rather than using paper. Buying reusable mugs and cups for your workplace is much more cost-effective and environmentally friendly than constantly buying single-use supplies. In a post-covid workplace, we recommend ensuring each member of staff has their own supplies to ensure the safety and health of your team.

2. Negotiate supply expenses

It never hurts to try and negotiate a lower price with supply vendors to see if you could get a better deal. If you have been with a vendor for the long-term, you can ask them to reward your loyalty and retain your custom by offering you a lower, more affordable price. If they are unable to do this, shop around for another vendor, you may be surprised at the savings you could make by switching to another supplier or company.

3. Reduce overheads

Do you really need an office? Since lockdown measures were put into place due to the global pandemic, many businesses are re-evaluating having a physical presence at all. It’s clear employees are adapting and thriving in a remote working environment and surveys show that by continuing to give your employees the choice to work from home, you will not only have a safer, happier team, but can significantly reduce your overhead costs by moving into a smaller office space or none at all. If you choose to have a smaller office space with fewer employees working physically in the office, this will also help you to lower your energy bills and keep employee expenses low.

4. Control expenditure

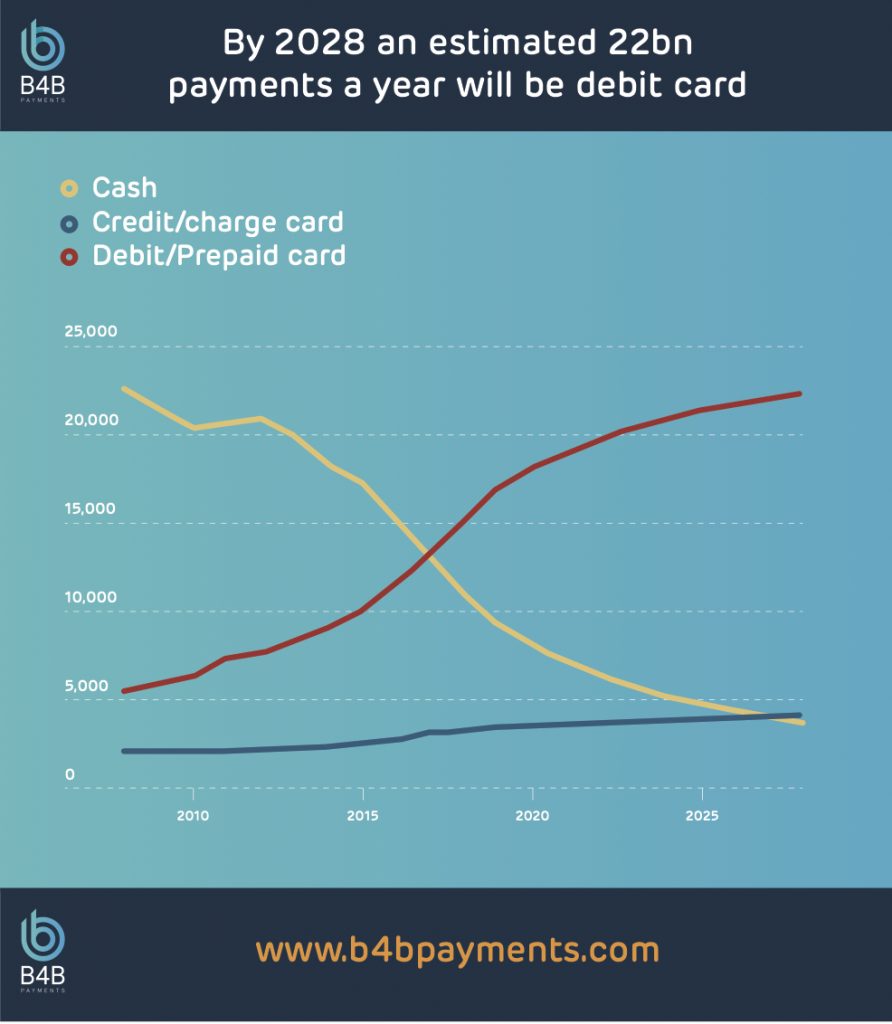

If you’re looking for an easy and efficient way to control employee expenditure, you may wish to consider B4B Payments. Having spent the last 14 years developing a robust prepaid card solutions that allows businesses to view and control their employee expenditure in real-time, ensures your organisation has total control and transparency over their employee expenses.

5. Reduce travel

Encourage all meetings to take place via video call or conference call, rather than allowing employees to travel frequently. This not only saves a company transport costs, but it also reduces the time employees spend and waste travelling from location to location. If it is essential departments or employees meet in person, use to ensure tracking your employees’ transport expenses is easy and you can factor this expense into your monthly or quarterly budget.

To learn more about the prepaid business card solutions that can help businesses of all sizes cut costs, contact B4B Payments today. From payroll to employee expenses and employee incentive management, we can help you manage your finances in one, convenient platform. Get in touch today to learn more about our effective solutions.