Hint: It’s cashless

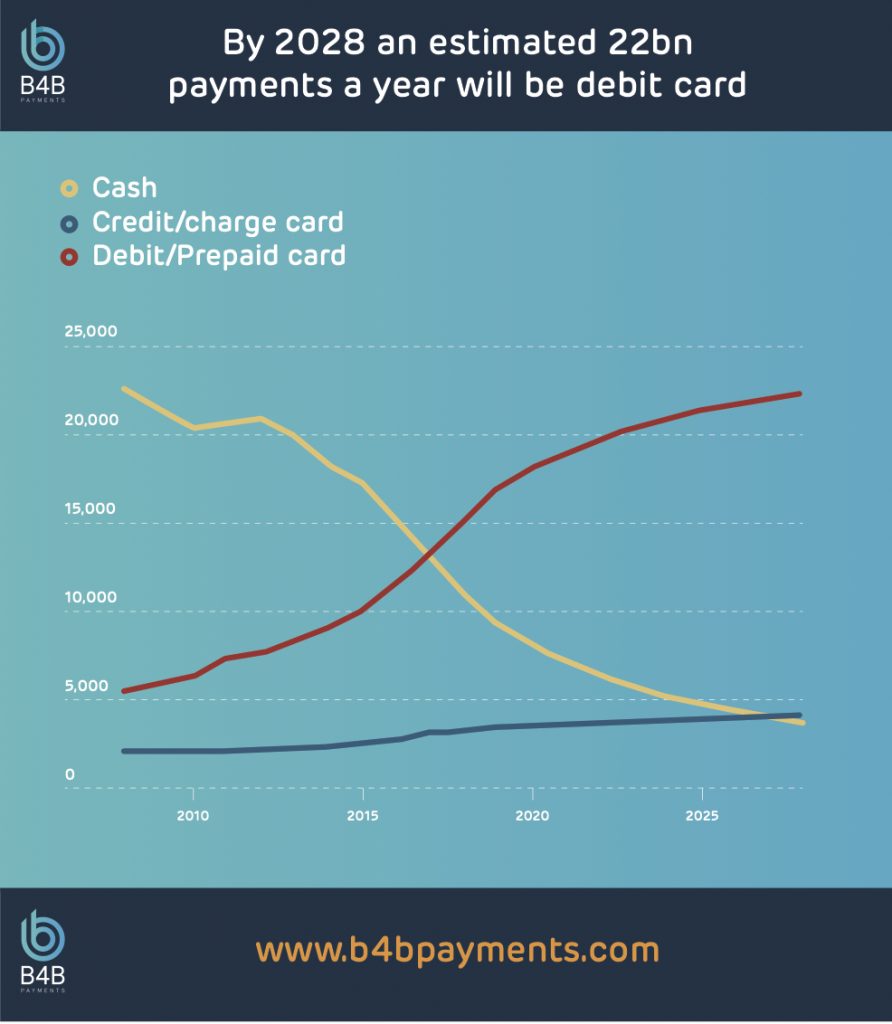

According to UK Finance, there were 39.3 billion payments made in the United Kingdom in 2018. Only 28% of these payments were made in cash, which is a 32% decrease over the past 10 years. By 2028, only 9% of payments are expected to be made in cash, so a huge number of businesses are choosing to ditch the payment method altogether.

The use of debit cards is on the rise and 98% of the UK population now use them regularly. Mobile and contactless payments are also on the increase and businesses from multiple industries, including hospitality and live events, are beginning to see the many benefits that cashless payment models have to offer.

Sports stadiums, however, have been slightly more hesitant to adopt a cashless payment system, due to their long history of customers bringing wads of cash to spend on refreshments and merchandise. However, whether you organise grassroots, domestic, or international sports events, utilising a cashless payment solution in all aspects of an organisation can offer the following benefits:

Prevent Fraud

Many sports venues employ a more transient workforce than other businesses, which can increase the likelihood of employees committing fraud or theft. Using cashless payments for business supplies, employees have fewer opportunities to steal from the organisation and any strange payment anomalies are easier to identify via the data collected from digital transactions. Physical cash can be extremely difficult to keep track of. With a prepaid, cashless payment solution, temporary employees will not be tempted to slip some into their pockets.

Increased customer spending

Research suggests that customers are likely to spend significantly more at sports stadiums when they are paying via card or mobile payments rather than with cash. When your customers don’t have to worry about calculating how much cash they have in hand and physically hand it over, they are much more likely to be freer with their spending, whether they’re purchasing food, drink or sporting merchandise. Depending on the size of your sporting venue, that could add up to hundreds of thousands of pounds more per event and could lead to a significant increase in profit.

Save time and money

Businesses are required to pay a small fee for every cashless payment transaction, but this is insignificant when compared to the money that they could save. Manual cash management takes a significant amount of time and it can often take several hours a day to maintain accurate accounting records. From making trips to the bank to counting cash at the end of the day, the minutes spent handling cash can add up and staff will often have to be paid overtime. Cashless sports venues don’t have to worry about the time spent handling manual payments and will find that they have more time to invest in more important tasks.

Social Distancing

The current global pandemic has seen a huge number of businesses switch to contactless card payments to maintain social distancing measures and reduce the spread of the coronavirus. UK sports stadiums are predicted to reopen as early as autumn, but the post-COVID-19 world is likely to see social distancing measures continue. With cashless payments, customers can safely and hygienically pay for items in sports arenas without having to worry about coming into contact with each other, so it’s likely that we’ll see a further spike in the use of cashless payments in venues all over the world.

If you run a grassroots, domestic or international sporting venue and are looking to eliminate antiquated payment processes and finally find the time to do the things that matter, B4B Payments has the perfect solution for you. Our prepaid cards can help you keep control over your corporate payments via a single platform and mobile app. Freeing up your business’s time and money, cut unnecessary costs, and streamline your accounting systems to make your business operations run seamlessly.